Priority given to reducing debt and optimizing WCR in the first half, positive net income driven by lower costs in response to lower volumes in Agricultural Spraying

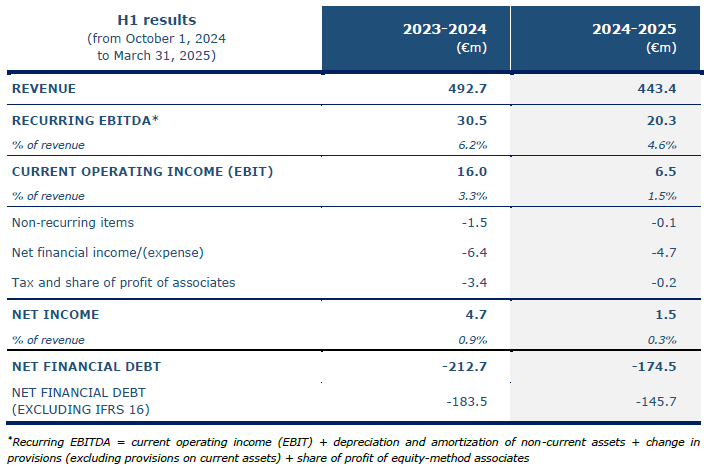

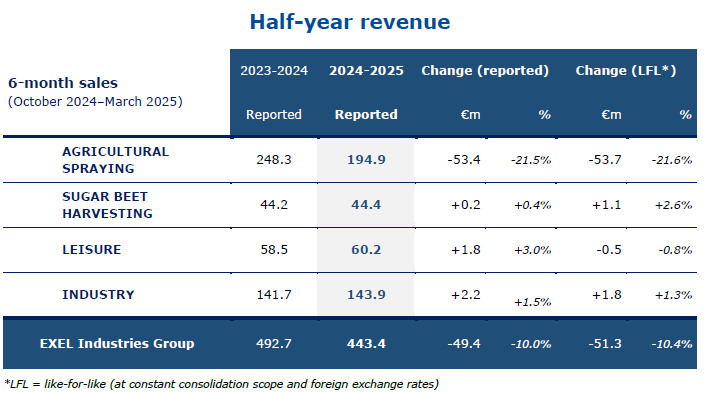

- In the first half of 2024–2025, EXEL Industries's revenue fell 10.0% to €443.4 million.

- The Group posted half-year recurring EBITDA of €20.3 million, representing 4.6% of revenue.

- Net income was positive at €1.5 million.

- The Group's level of net financial debt improved by €38 million compared with last year, as a result of efforts to reduce WCR and, in particular, inventories. EXEL Industries continues to focus on debt reduction and cash flow generation.

In the first half of 2024–2025, the Group generated revenue of €443.4 million, down 10.0%. On a like-for-like basis, revenue was down 10.4%, mainly due to lower volumes in Agricultural Spraying, with other activities either stable or growing.

Half-year financial results

Recurring EBITDA amounted to €20.3 million – or 4.6% of Group revenue, compared with 6.2% in 2023–2024. In response to the overall reduction in revenue due to lower volumes in Agricultural Spraying, the Group placed an emphasis on cutting costs and optimizing margins.

At March 31, 2025, net income amounted to €1.5 million, compared with €4.7 million in 2023–2024, impacted by the decline in recurring EBITDA.

Net financial income was negative at -€4.7 million, but improved by €1.7 million compared with the first half of last year, thanks to lower average gross indebtedness, combined with lower interest rates, and less unfavorable foreign exchange losses than at March 31, 2024.

Balance sheet

At March 31, 2025, net financial debt stood at €174.5 million, compared with €212.7 million in the first half of 2024, a marked improvement of €38 million, as a result of efforts to optimize WCR, mainly driven by a significant reduction in inventory levels compared with the first half of the previous year. However, the change in WCR remained negative over the first half of 2024–2025 at €30 million, in line with the seasonal nature of the Group's business (compared with €77.7 million in the first half of 2023–2024).

The Group upholds its investment policy, with Capex amounting to €15.6 million, notably including ongoing construction work on the new Sames plant in Stains, France.

At the same time, EXEL Industries continued to renew its credit lines for its operating requirements.

Audit process

The Group Audit Committee met on May 20, 2025.

The Board of Directors met on May 21, 2025 and approved EXEL Industries's half-year financial statements at March 31, 2025.

The Group’s Statutory Auditors have finished certifying the first half financial statements and will shortly issue a report without reservations.

2025 outlook

- In Agricultural Spraying, order intake continues to offer limited visibility, but is beginning to show signs of recovery, mainly in Europe and in the large-scale crops markets. The outlook for European viticulture markets remains uncertain over the coming months.

- In Sugar Beet Harvesting, market conditions are uncertain, with an overall market downturn in Europe due to a decline in cultivated areas, and a wait-and-see attitude in North America (weaker dollar, higher interest rates and lower sugar prices).

- In the Garden segment, business is well oriented for the rest of the year, with order intake levels that remain satisfactory.

- In Industrial Spraying, sales prospects remain dynamic in Europe and North America, but are expected to slow down in Asia.

- Due to the economic uncertainty related to the US tariff policy, EXEL Industries is assessing its effects on costs and supply chains in order to take appropriate measures in its agricultural and Industrial Spraying activities.

- In activities suffering from lower volumes, the Group will continue to align its production capacities and cost structure with the level of business.

- The Group intends to pursue its efforts to generate cash flow, notably by optimizing its WCR through the reduction of inventories across all its activities.

Daniel Tragus, Chief Executive Officer of the EXEL Industries Group

“The Group posted positive first-half results in an uncertain macroeconomic environment. Our efforts to reduce costs have started to bear fruit and have helped mitigate the impact of declining volumes in Agricultural Spraying on our margins. Across all our activities, we also worked to optimize WCR by successfully reducing inventory levels. We are confident for the rest of the fiscal year, with priorities remaining on debt reduction and cash flow generation, while continuing our long-term investment policy.”

Upcoming events

- May 23, 2025: presentation of half-yearly results to investors

- July 23, 2025, before market opening: Q3 2024-2025 revenue

- October 24, 2025, before market opening: 2024-2025 full-year revenue