Operating cash flow before tax over €100m and net debt down €30m

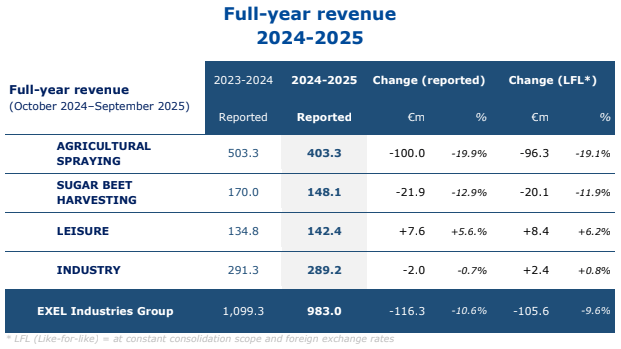

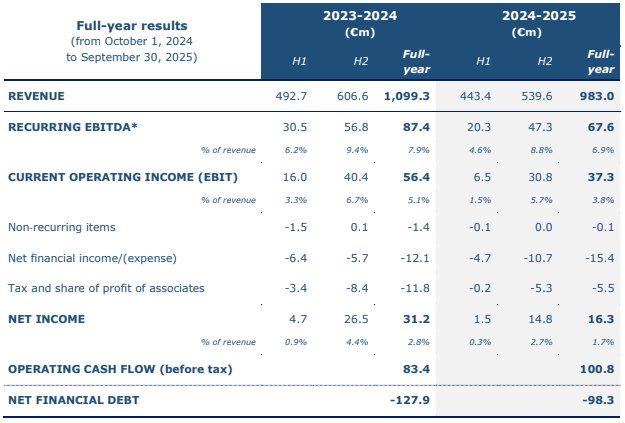

- In 2024–2025, EXEL Industries' revenue amounted to €983 million, down 10.6%, representing a 9.6% reduction at constant scope and foreign exchange rates.

- The Group posted recurring EBITDA of €67.6 million and a margin of 6.9%, following a 2024–2025 fiscal year marked by significant volume reductions in the Agricultural Spraying and Sugar Beet Harvesting activities.

- Net income amounted to €16.3 million, mainly impacted by the decline in current operating income, a direct consequence of lower volumes in agricultural activities.

- The payment of a dividend of €0.60 per share will be proposed at the General Meeting on February 4, 2026.

- While maintaining a dynamic investment policy, the Group reduced its net financial debt by nearly €30 million.

Financial results

Recurring EBITDA was down to €67.6 million – or 6.9% of Group revenue, compared with €87.4 million, or 7.9% of sales, in 2023–2024. EBITDA suffered from the sharp decline in volumes in the Agricultural Spraying and Sugar Beet Harvesting activities, which were not offset by the growth in Leisure and the stability of Industry. Efforts made with regard to the cost structure began to bear fruit, allowing the Group to adjust its expenses to the level of activity.

Net income was down to €16.3 million, compared with €31.2 million in 2023–2024, mainly due to the decline in EBITDA stemming from lower volumes. Over the fiscal year, the reduction in the cost of debt, as a result of the fall in interest rates and the reduction in average debt over the fiscal year – particularly in the second half of the year – made it possible to reduce financial expenses. However, this positive effect was mitigated by unfavorable currency effects, bringing the net financial income/(expense) to –€15.4 million.

Balance sheet

Net financial debt (NFD) amounted to €98.3 million as of September 30, 2025, down from €127.8 million in 2024. This decrease of around €30 million resulted from improved cash generation over the fiscal year, following the reduction in working capital requirements.

This sound management of resources enabled the Group to pursue its dynamic investment policy to modernize its industrial sites and production tools, with a total of €32.6 million in CAPEX over the fiscal year.

In June 2025, the first batch of new buildings at its factory in Stains, France (Industry) was inaugurated. Work was initiated in 2023, for a total amount of approximately €20 million, including nearly €9 million for the 2024–2025 fiscal year.

Lastly, EXEL Industries renewed several lines of credit to cover its current needs and possible acquisitions, these new lines being systematically indexed to CSR criteria.

Dividend

A dividend of €0.60 per share, corresponding to 25% of consolidated net income, will be submitted for approval at the General Meeting on February 4, 2026.

Audit process

The Group Audit Committee met on December 16, 2025.

The Board of Directors met on December 16, 2025, and approved the EXEL Industries annual and consolidated financial statements as of September 30, 2025.

The Group’s Statutory Auditors have finished certifying the annual and consolidated financial statements and will shortly issue a report without reservations.

2026 outlook

AGRICULTURAL SPRAYING

After two exceptional years and a significant slowdown in 2024–2025, business is gradually returning to its usual seasonality. However, the business climate remains difficult and uncertain, despite the slight rebound in orders recorded in the second half of the year. The order book, which is low, continues to provide limited visibility. At least over the first part of the 2025–2026 fiscal year, this slowdown is expected to continue.

SUGAR BEET HARVESTING

Market conditions remain uncertain in Europe, mainly due to the reduction in cultivated areas, but also in North America, where the wait-and-see attitude is ongoing. In 2026, just as in Agricultural Spraying, the Group will continue to develop the after-sales business in Sugar Beet Harvesting, with an enhanced range of services and strengthened sales of spare parts.

LEISURE

- The irrigation market is expected to continue the recovery that began in 2024-2025, with stabilized market shares and developments in new regions.

- The Nautical market remains sluggish, with dealer inventories which are still high.

INDUSTRY

- In line with 2025, 2026 will see the roll-out of ERP and the continuation of the industrial transformation. Industrial Spraying operates in a demanding industrial environment, and the Group is continuing to expand into new markets and to innovate.

- In Technical Hoses, the focus is on improving the product range, developing the circular economy, operational efficiency, and commercial momentum.

Daniel Tragus, Chief Executive Officer of the EXEL Industries Group

"EXEL Industries has once again demonstrated the robustness of its model. The complementary nature of our activities and business lines enabled us to cushion the impacts of a difficult agricultural context. In 2024–2025, the Group was able to adapt to a less buoyant market environment, staying on course operationally while strengthening its financial discipline. The reduction in our net debt, underpinned by improved cash flow generation, and the sustained level of our investments illustrate the strength of our fundamentals. We are approaching the coming fiscal year with pragmatism and confidence, remaining faithful to our strategic roadmap."

Upcoming events

- January 28, 2026, before market opening: Q1 2025-2026 revenue

- February 4, 2026: Annual General Meeting

- April 24, 2026, before market opening: Q2 2025-2026 revenue