Sharp improvement in second half margins

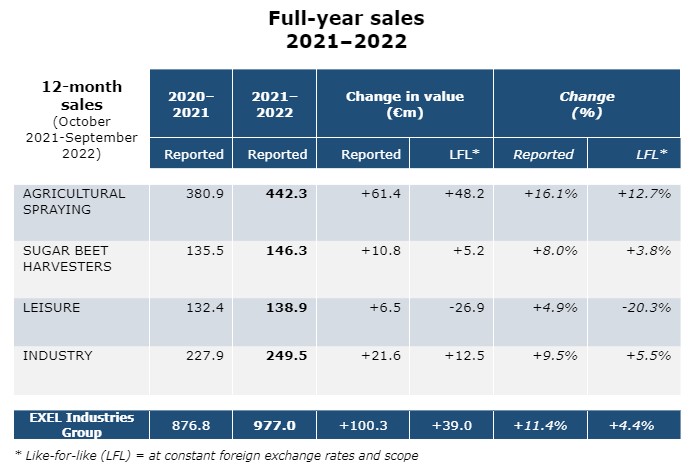

- With sales up 11.4%, all business lines except gardening posted growth at constant foreign exchange rates and scope.

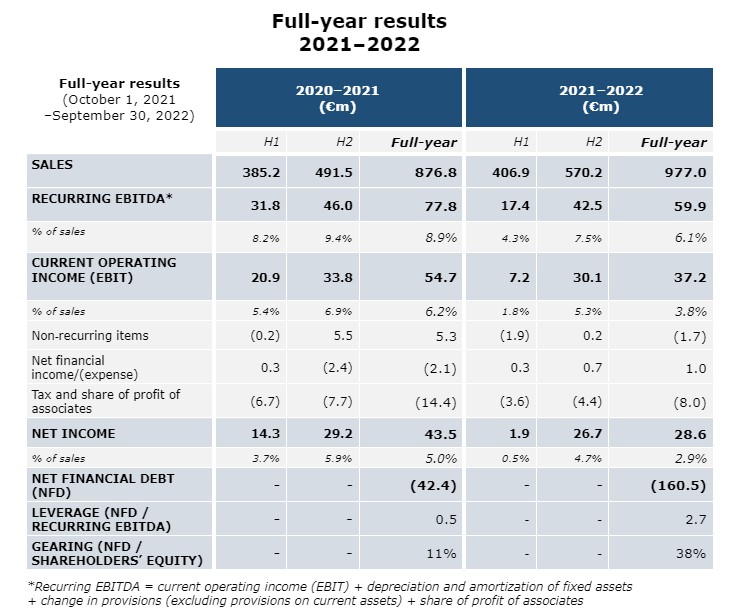

- Resilient business model, with second half recurring EBITDA just below last year’s level, and totaling €60 million for the full year, giving a margin of 6.1%.

- Net income just below €29 million.

- Proposed dividend payment of €1.05 per share.

Sales growth, inflation, supply shortages and the large order book expected for 2022–2023 led to a significant increase in the Group’s working capital requirements, which, combined with the acquisitions, caused net debt to rise.

Full-year 2021–2022 sales amounted to €977.0 million, up 11.4%. Growth at constant foreign exchange rates and scope was 4.4%. In response to rising raw material and component costs, EXEL Industries has endeavored to optimally adjust prices across all business lines. This policy implemented throughout the year offset certain volume declines due to shortages (mainly in agricultural equipment) or the market (gardening). The currency effect was particularly favorable to the agricultural spraying and industry segments.

The change in consolidation scope represented sales of €29.8 million for the year. Comments on sales per activity are detailed in our press release of October 27, 2022. As previously announced, the Italian company G.F. was acquired on February 15, 2022.

Financial performance

Recurring EBITDA was down to €60 million, or 6.1% of Group sales, compared to €78 million or 8.9% of sales in FY 2020–2021.

This decline can be explained by several factors:

- On the one hand, in agricultural equipment, shortages, inflation, and supply chain disruption lengthened production lead times and reduced margins, even though the Group’s main brands adjusted their pricing policies throughout the year and posted better results in the second half.

- After two exceptional years due to the health crisis, the market for garden equipment has returned to its former level. On the other hand, the challenging IT migration carried out in the second quarter curbed Hozelock sales volumes.

- Lastly, after four years of relative stability, overheads increased this year due to acquisitions, the ramp-up of EXXACT Robotics, and the distribution of a purchasing power bonus to all Group employees totaling €3 million.

Net income was down to €28.6 million versus €43.5 million in FY 2020–2021. This decrease is mainly due to the reduction in EBITDA and non-recurring items, which were boosted last year by a €5.3 million gain from the revaluation of UK pension commitments. Net income includes the following items:

- a €1.7 million net non-recurring expense, comparable to the first half of the year and mainly comprising impairment losses on destroyed assets in the Ukraine war zone.

- €1.0 million net financial income including borrowing costs and other financial expenses totaling around €3.5 million, more than offset by favorable foreign exchange rates (+€4.5 million). Changes in foreign exchange rates in 2020–2021 had virtually no impact on the Group.

- a recognized tax expense of €8.6 million, benefiting from reductions in tax rates in some countries, including France.

Balance sheet

Net financial debt (NFD) amounted to €160.5 million at September 30, 2022, compared to €42.4 million last year. The decrease in cash over the year is mainly due to working capital requirements, up sharply due to fourth quarter sales growth (up 23% versus Q4 2020–2021) and component shortages. These shortages, less acute than during the first half but still present, prompted the Company to secure the supply of key components in view of the large order book at the start of the 2022–2023 fiscal year. Temporary factors (acquisitions, decrease in EBITDA, and higher working capital) increased 2021–2022 leverage (NFD/recurring EBITDA) to 2.7. However, as the Group’s lines of credit are not subject to covenants, this will not trigger the immediate repayment of debt.

Furthermore, the EXEL Industries Group has lines of credit that allow it to support its operating and, where applicable, external growth requirements. Several lines of credit have recently been renewed, for which interest rates will be adjusted in accordance with the achievement of CSR targets. Some lines were switched to fixed rates when the interest rate curve steepened.

Dividends

A dividend of €1.05 per share corresponding to 25% of consolidated net income will be proposed to the Annual General Meeting on February 7, 2023.

Audit process

The Group Audit Committee met on December 14, 2022.

The Board of Directors met on December 15, 2022, and approved the Group parent company and consolidated financial statements for the year ended September 30, 2022.

The Statutory Auditors have finished certifying the parent company and consolidated financial statements and will shortly issue a report without reservations.

Sustainable development

After initiating an ambitious process, the Group has continued to strengthen its sustainable development policy, with new financings indexed to CSR criteria and the creation of a CSR committee within the Board of Directors. In 2021–2022, EXEL Industries launched a new initiative at Group level to identify the main catalysts to reduce its Scope 3 greenhouse gas emissions.

Outlook

AGRICULTURAL SPRAYING

- Agricultural commodity prices are expected to remain high, which will continue to drive machine replacement.

- Despite the uncertainty surrounding the Russia-Ukraine conflict, our business continues to thrive in this region, in compliance with international sanctions.

- The order book remains well-stocked for the coming quarters.

- The business is maintaining rigorous discipline with regard to selling prices in line with the impact of inflation on our costs.

- The innovations presented at the SIMA international exhibition of agricultural technologies were highly appreciated and are entering the marketing phase.

SUGAR BEET HARVESTERS

- Given the announced surge in beet prices to levels advantageous to farmers, sales of new machines are expected to maintain good volumes in 2022–2023.

- The field transport vehicle market is expected to continue to grow in Western Europe.

LEISURE

- Commercial and industrial synergies are strengthening following the integration of G.F.

- The problems encountered during the IT migration have now been resolved, thereby enabling the business to further improve its service to customers.

- The reorganization of the nautical business continues, and the return of the Wauquiez, Rhéa, and Tofinou brands to trade fairs towards the end of summer received attention.

INDUSTRY

- Asia and North America are expected to remain the drivers of volume growth. Most of our product ranges were renewed and are positioned as premium products.

Yves Belegaud, Chief Executive Officer of the EXEL Industries Group

“The 2021–2022 year saw contrasting trends, with a challenging first half followed by margin improvement in the second half thanks to more rigorous price discipline, even if shortages continued to have an impact. The Group has launched various action plans to reduce inventory levels as far as possible. Bolstered by a well-filled order book, the Group is confident about the coming fiscal year despite the current macro-economic uncertainty. Lastly, EXEL Industries has assigned greater priority to sustainable development in its strategy.”

Upcoming events

- January 25, 2023, before market opening: Q1 2022–2023 sales

- April 25, 2023, before market opening: Q2 2022–2023 sales

- May 26, 2023, before market opening: H1 2022–2023 results