Une année record boostée par un 2e semestre exceptionnel

- Pour la première fois de son histoire, EXEL Industries dépasse 1 milliard d’euros de chiffre d’affaires, en hausse de 12,0 %.

- Le Groupe retrouve des niveaux de profitabilité équivalents à ceux de 2021, avec un EBITDA récurrent annuel de près de 94 millions d’euros et une marge de 8,6 %.

- Le résultat net s’élève à 42,5 millions d’euros, fortement affecté par un résultat financier négatif.

- Le versement d’un dividende de 1,57 € par action sera proposé à l’assemblée générale du 6 février 2024.

Malgré un environnement toujours inflationniste, le Groupe a porté sa priorité au désendettement en générant plus de 43 millions d’euros de cash-flow.

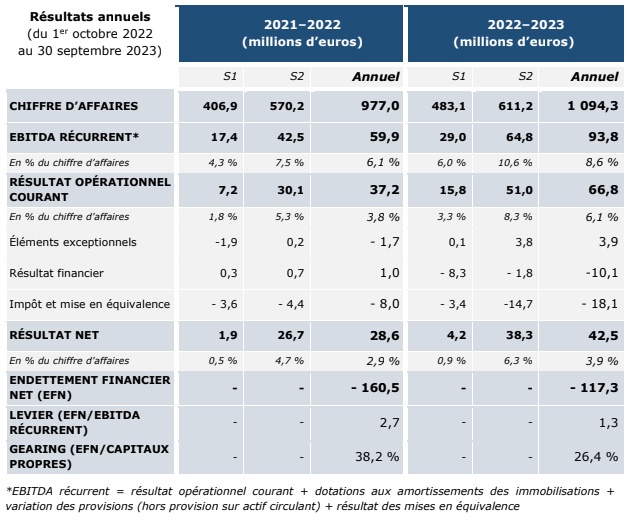

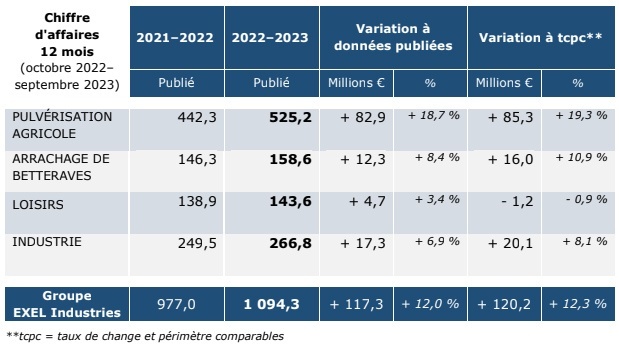

Chiffre d’affaires annuel 2022–2023

Le chiffre d’affaires annuel 2022–2023 de 1,1 milliard d’euros est en hausse de 12,0 %. À périmètre et taux de change constants, la croissance d’EXEL Industries ressort à 12,3 %. Les hausses de prix passées pendant l’année et la bonne tenue des volumes dans les agroéquipements et l’industrie ont permis de soutenir cette performance, en dépit du recul du marché du jardin cette année.

L’effet périmètre représente 8,1 millions d’euros de chiffre d’affaires sur l’exercice 2022–2023, en conséquence des acquisitions de G.F. en février 2022 et de Devaux en juin 2023.

Résultats financiers

L’EBITDA récurrent est en croissance à 93,8 millions d’euros – soit 8,6 % du chiffre d’affaires Groupe, contre 59,9 millions d’euros ou 6,1 % des ventes en 2021–2022.

Plusieurs facteurs expliquent cette hausse :

- D’une part, les hausses de volumes dans la pulvérisation agricole et dans la pulvérisation industrielle ont en partie compensé les ralentissements dans le jardin.

- D’autre part, dans la pulvérisation agricole, le jardin et, dans une moindre mesure, la pulvérisation industrielle, les augmentations de prix ont permis de compenser les hausses des coûts de production et des frais généraux.

Le résultat net retrouve un niveau quasi-équivalent à celui de 2021 à 42,5 millions d’euros, et très au-dessus de l’exercice 2021–2022 à 28,6 millions d’euros. Malgré la forte croissance de l’EBITDA et un résultat exceptionnel favorable, le résultat net Groupe est fortement affecté par le résultat financier négatif et par une charge d’impôt plus élevée qu’en 2021–2022.

Il se compose des éléments suivants :

- Un résultat exceptionnel positif de 3,9 millions d’euros, en quasi-totalité sur le 2e semestre, qui comprend principalement une indemnité d’assurance dommage aux biens et les conséquences des évolutions de périmètre de l’exercice.

- Un résultat financier négatif de - 10,1 millions d’euros, constitué de la charge de la dette (augmentation des taux d’intérêt) et d’autres charges financières diverses pour environ - 6 millions d’euros. De plus, l’évolution négative des taux de change, notamment de l’euro par rapport au dollar américain, a fortement affecté le résultat, pour - 4,1 millions d’euros. En 2021–2022, l’évolution des parités monétaires avait été favorable pour le Groupe à + 4,5 millions d’euros.

- Une charge d’impôt comptabilisée de - 19,0 millions d’euros, en ligne avec l’évolution du résultat courant avant impôts et plus importante qu’en 2022, année exceptionnellement basse.

Bilan

L’endettement financier net (EFN) ressort à 117,3 millions d’euros au 30 septembre 2023, comparé à 160,5 millions d’euros en 2022. Sous l’effet d’éléments conjoncturels (hausse de l’EBITDA et réduction du BFR), le levier financier de l’année 2022–2023 (EFN/EBITDA récurrent) s’améliore et repasse à 1,3.

Par ailleurs, le Groupe a poursuivi une politique d’investissement ambitieuse pour continuer de moderniser ses usines et continuera en 2023–2024 avec le lancement des travaux de modernisation de son usine de Stains en France (Industrie).

Même si EXEL Industries a subi une hausse brutale de son BFR en 2022, le BFR s’est amélioré en 2023, malgré une croissance importante de l’activité.

Enfin, EXEL Industries dispose de lignes de financement largement suffisantes pour subvenir à ses besoins et celles-ci sont systématiquement renouvelées avec des critères RSE.

Gouvernance

À l’issue du Conseil d’administration réuni le 20 décembre 2023, Daniel Tragus a été nommé pour succéder à Yves Belegaud en tant que Directeur général d’EXEL Industries. À la tête du Groupe depuis 2019, Yves Belegaud avait annoncé au Conseil d’administration son intention de faire valoir ses droits à la retraite à compter de janvier 2024. La transition s’est donc déroulée dans les meilleures conditions.

Dividende

Il sera proposé à l’Assemblée Générale du 6 février 2024 la distribution d’un dividende de 1,57 € par action, correspondant à 25 % du résultat net consolidé.

Processus d’audit

Le Comité d’audit du Groupe s’est réuni le 19 décembre 2023.

Le Conseil d’administration s’est réuni le 20 décembre 2023 et a arrêté les comptes annuels et consolidés d’EXEL Industries au 30 septembre 2023.

Les procédures de certification des comptes annuels et consolidés ont été effectuées et un rapport sans réserve est en cours d’émission par les commissaires aux comptes du Groupe.

Développement durable

L’année 2022–2023 s’est traduite par des avancées majeures en ce qui concerne l’identification et la traduction des enjeux ESG dans la stratégie d’EXEL Industries. Le Groupe a réalisé des matrices de matérialité et des bilans carbone qui couvrent l’ensemble de ses activités. Conduite d’abord à l’échelle des sociétés, la démarche a ensuite été agrégée par division et au niveau Groupe afin de mettre en œuvre les politiques appropriées.

Perspectives 2024

- PULVÉRISATION AGRICOLE

- Les commandes engrangées ces derniers mois permettent d’avoir une bonne visibilité sur l’exercice 2023-2024, quelles que soient les marques et les géographies. Le carnet de commandes, certes inférieur à la même époque l’an passé, reste soutenu et devrait permettre de suivre une saisonnalité des ventes assez similaire à celle de l’exercice 2022-2023. Néanmoins, le reflux des prix agricoles et la hausse des taux d’intérêts incitent les agriculteurs à plus de prudence.

ARRACHAGE DE BETTERAVES

- Deux éléments ont bénéficié aux ventes de machines neuves en 2022-2023 :

- D’une part, les cours du sucre atteignent des niveaux records depuis le printemps et semblent se maintenir aujourd’hui encore à ces niveaux élevés, redonnant de la confiance aux agriculteurs ;

- D’autre part, alors que les taux de change étaient favorables aux agriculteurs, le renouvellement exceptionnel de machines installées en Europe de l’Est a été un effet d’aubaine qui ne se représentera vraisemblablement pas sur l’exercice 2024.

LOISIRS

- Depuis début janvier 2023, le marché de l’arrosage a connu une baisse en volume en France et au Royaume-Uni. Sous réserve d’une météo plus favorable, l’année 2024 devrait permettre le retour de la croissance des volumes après deux années consécutives de baisse.

- L’intégration de Devaux a commencé : la saison étant déjà bien avancée au moment de l’acquisition, les efforts portent sur l’amélioration des processus industriels conformes aux standards du Groupe.

INDUSTRIE

- Le carnet de commandes se maintient globalement dans la pulvérisation industrielle et devrait rester soutenu en 2024 par les nouvelles mises en chantier en Amérique du Nord. En Asie et en particulier en Chine, le marché du bois devrait reculer tandis que la croissance dans l’automobile devrait se poursuivre, bénéficiant d’investissements importants en lien avec l’électrification.

- Peu de changements sont attendus sur le marché des tuyaux.

Yves Belegaud, Directeur général du groupe EXEL Industries jusqu’au 20 décembre 2023

« Je quitte EXEL Industries, fier d’avoir réalisé un très bon dernier exercice. Après avoir souffert en 2022 du contexte économique, des pénuries de composants, d’une inflation rapide et forte ayant pénalisé les résultats économiques du Groupe l’an passé, EXEL Industries a su revenir à une gestion financière plus saine de son bilan. Je suis convaincu que Daniel Tragus mettra à profit son leadership et sa connaissance intime du Groupe pour poursuivre cette stratégie de croissance rentable et génératrice de trésorerie. »

Daniel Tragus, Directeur général du groupe EXEL Industries depuis le 20 décembre 2023

« Dans un environnement de marché difficile, certes moins inflationniste mais occasionnant cependant encore des perturbations dans nos chaînes de production, EXEL Industries a su donner la priorité tant à la poursuite de sa croissance organique et externe qu’à la gestion stricte de ses coûts et de son désendettement. En s’appuyant sur un carnet de commandes encore solide et malgré quelques signes de ralentissement dans le domaine agricole, je suis confiant dans les perspectives et les fondamentaux du Groupe, soutenu par une politique de Responsabilité Sociale et Environnementale ambitieuse et par des équipes engagées. »

Retrouvez les résultats annuels du groupe EXEL Industries sur notre page investisseurs

Télécharger le communiqué de presse

Prochains rendez-vous

- 25 janvier 2024, avant bourse : chiffre d’affaires du 1er trimestre 2023–2024

- 6 février 2024 : assemblée générale des actionnaires

- 24 avril 2024, avant bourse : chiffre d’affaires du 2e trimestre 2023–2024