Decline in EBITDA in challenging economic conditions marked by record high inflation and severe supply chain disruptions

- Order book at a record high.

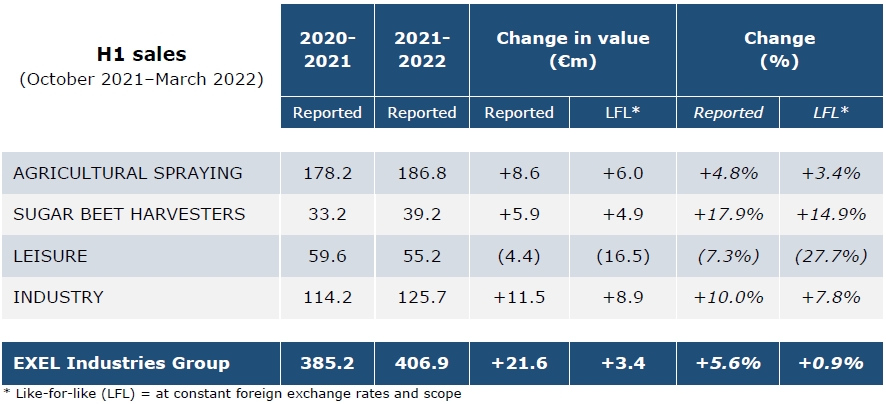

- Sales up 5.6%, showing an increase in all businesses apart from gardening.

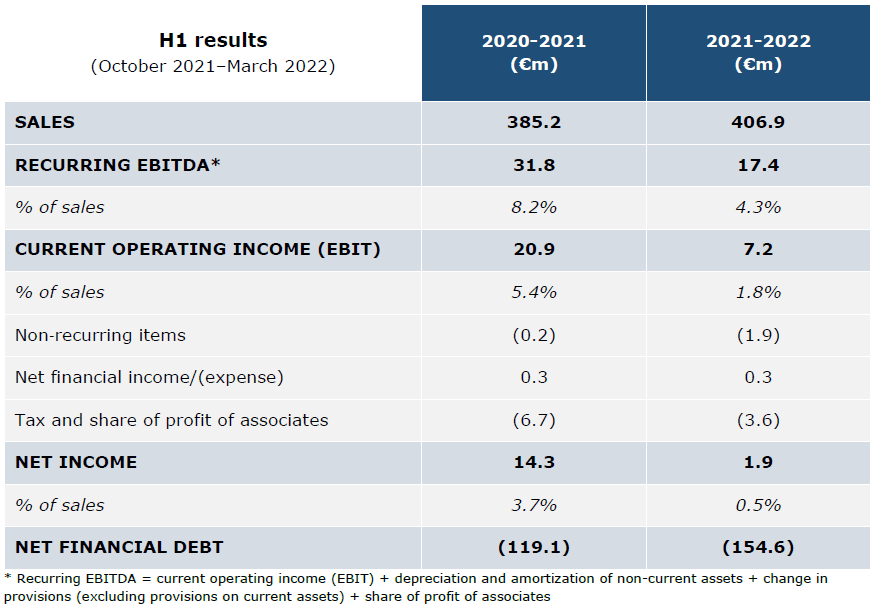

- Supply shortages had a severe impact on financial performance, with recurring EBITDA down compared to last year at €17.4 million, and a recurring EBITDA margin of 4.3%.

- Positive net income of €2 million.

- Acceptable level of debt and financial ratios for the Group, despite an increase in working capital linked to business activity and work-in-progress.

- Consolidation of G.F. since February 15, 2022.

Situation in Ukraine and Russia

As of March 31, the Group reviewed its exposure, in particular its accounts receivable with Ukrainian and Russian customers and identified no payment default in connection with the conflict. Some orders from these countries have been canceled without leading to inventory impairment. One of the two sites belonging to the Holmer Ukraine subsidiary is located in the war zone: damage to buildings, which have been severely hit by Russian attacks, led to a €1.3 million loss recorded under non-recurring items. We have identified no additional risks to date, and EXEL Industries is maintaining as much business as possible in compliance with European rules.

As a reminder, Russia, Belarus, and Ukraine accounted for 4% of Group sales in FY 2020–2021.

Acquisition

On February 15, 2022, the Group announced the strategic acquisition of G.F., a long-standing Italian manufacturer of garden equipment including watering, irrigation, gardening, and outdoor living products. Operating in over 50 countries, G.F. posted sales of €34 million in 2021.

Sales

First half 2021–2022 sales increased by 5.6%, reaching €406.9 million, impacted by different trends depending on the business.After a strong first quarter with growth across all businesses, the second quarter saw mixed trends: some businesses, including industry and sugar beet harvesting, posted growth in terms of both volume and price. Agricultural spraying achieved growth due to higher prices offsetting ongoing consecutive cost increases since the beginning of 2021 (steel, mechanical components, and electronics…). Volumes are affected by supply chain disruption in all regions. Lastly, the Leisure business benefited from the perimeter entrance of the Nautical industry but hampered by the decline in the gardening market (down 15% over the January-March 2022 period). This was exacerbated by the disruption stemming from the IT system migration at Hozelock during the second quarter.

During the first half, the Group posted strong commercial results across different regions (Australia, Asia, North America). Europe proved resilient but slightly decreased, mainly due to the gardening business.

Results

At €17.4 million (4.3% of sales), reported recurring EBITDA was down €14.4 million compared to the record performance in H1 2020-2021. This decline can be explained by several factors:

- Primarily in the Agricultural Spraying business, the Group endeavored to manage supply shortages throughout the first half against a backdrop of hyperinflation that affected margins. The fall in volumes in the gardening business, linked to a slowdown in its underlying market following two years of strong growth (during the pandemic in 2020, and further growth in 2021) and to the challenging migration of IT systems, sharply impacted EBITDA.

- Lastly, after two years of heavy restrictions, overheads have increased in order to support business growth and contribute to the Group’s operational transformation.

Net income totaled €1.9 million, versus €14.3 million in 2021.

- The €1.9 million net non-recurring loss mainly includes impairment of damaged or destroyed assets located in the Ukrainian war zone.

- Net financial income is stable at €0.3 million: foreign exchange gains came to €2 million, similar to the previous year, despite contrasting evolutions for some currencies; this foreign exchange gain was offset by financial expenses linked to the increase in debt.

- The recognized tax expense of €3.8 million, although high compared to Group profit before tax, is due to the varied results posted by the different businesses.

Balance sheet

Net financial debt at March 31, 2022 was €155 million, compared to €119 million in 2021. The increase in net debt stems from three events: dividend payment for the first time in two fiscal years, totaling €11 million, the G.F. acquisition and the increase in inventory (mainly work-in-progress) due to supply shortages. During the first half, supply shortages disrupted production at Group plants and significantly increased the inventory of semi-finished products. During the second half, EXEL Industries will strive to significantly reduce inventory and generate cash flow.

Furthermore, the Group continues to refinance its lines of credit by diversifying issuers and extending maturities in order to meet operational and external growth requirements without disrupting the balance sheet structure over the long term.

Perspectives

Caring about the impact of inflation on its employees’ daily life, EXEL Industries has decided to grant all of them an exceptional bonus for solidarity purposes and purchasing power. This bonus, which represents overall an estimated cost of €3 million for the Group, will be the same amount for each eligible employee in the world.

AGRICULTURAL SPRAYING

Agricultural commodity prices are expected to remain at high levels, encouraging farmers to renew their machines, especially for large-scale crops farmers.

Commercial brands are adjusting their sales prices, to offset the steel and components costs increases and to try to limit the impact on margins.

The order book is rising ahead of its 2020-2021 levels, but supply chain disruptions (components) persist and will continue to affect productivity and the pace of deliveries. Some of the orders initially earmarked for the Ukrainian and Russian markets are redirected to other regions.

SUGAR-BEET HARVESTERS

Stabilization of new machine sales expected in the fiscal year, despite canceled/delayed orders in Ukraine and Russia.

Confirmation that the diversification into the Terra Variant range can act as a driver of growth into new regions.

Sales of spare parts and used machines remain strong.

LEISURE

As anticipated, volumes are gradually recovering, following the change of ERP software implemented in the second quarter (migration to SAP).

The gardening business fell after an exceptional year in 2021.

The new Easy-Mix composter, which has won a string of awards from different organizations, looks set to grow sales.

After briefly stabilizing, commodity prices are rising up again.

The commercial and industrial restructuring of the nautical activity continues.

INDUSTRY

The automotive market is difficult in all regions, with carmakers showing signs of a wait-and-see attitude and experiencing supply shortages.

Asia and America should continue to support growth in other markets.

Upcoming meetings

May 31, 2022: SFAF meeting.

July 26, 2022, after market closing: Q3 2021-2022 sales.