First quarter impacted by a downturn in agricultural sales, but other activities holding up well

First quarter 2024-2025

revenue

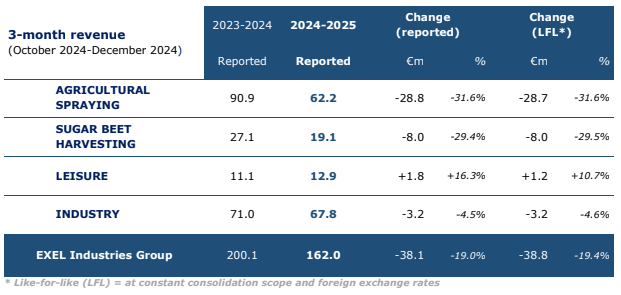

The EXEL Industries Group posted revenue of €162.0 million for the first quarter of the 2024-2025 fiscal year, down 19.0% as reported and 19.4% at constant foreign exchange rates and scope.

- AGRICULTURAL SPRAYING DOWN 31.6%

Agricultural Spraying sales showed an expected decline of 31.6% as reported, penalized by low volumes and a challenging business climate. This downturn follows two exceptional years in the agricultural equipment sector, and business now seems to be returning to a more traditional seasonal pattern. Business is returning to the level of the 2021–2022 fiscal year. Revenue was down in the Group’s main regions, namely Europe, North America and Australia.

- SUGAR BEET HARVESTING DOWN 29.4%

Sugar Beet Harvesting sales were down compared with the first quarter of the 2023-2024 fiscal year, which was particularly strong with a catch-up in deliveries related to the previous fiscal year. The slight time lag between production schedule and actual sales should be resolved in the second quarter of 2024-2025.

- LEISURE UP 16.3%

In the first quarter, sales in the Garden division improved across all main Group regions, particularly France and the United Kingdom. Distributor inventory levels remain relatively low, with pre-season sales better than last year and in line with expectations.

- INDUSTRY DOWN 4.5%

Industry revenue for the first quarter of the 2024–2025 fiscal year was stable year-on-year, except for a slight downturn in Asia, particularly in electrostatics. On the other hand, in Europe, and particularly in Western Europe, as well as in North America, sales remained buoyant.

2025 outlook

- AGRICULTURAL SPRAYING

After two exceptional years, business has returned to a normal seasonal pattern. The level of order intake has fallen significantly over the past fiscal year, with less long-term visibility than in the previous three years, calling for a degree of caution. Production capacities have been adjusted to the level of activity, and the Group remains vigilant with regard to changes in its cost structure. However, the agricultural equipment market cycle, particularly in Europe, seems to have reached its lowest point, with improving prospects.

- SUGAR BEET HARVESTING

The order book is solid at the end of the first quarter, and the outlook is well-oriented for the year. In 2025, priority continues to be given to developing the after-sales activity with enriched services to better support its customers in using its products.

LEISURE

- The outlook for the Garden division is encouraging, with early pre-season sales up on 2023–2024 and lower distributor inventory levels. These factors should lead to a better pre-season overall than last year.

- The Nautical market remains challenging, with distributor inventories still high. Having completed production in fall 2024, the Wauquiez 55 was presented at the Düsseldorf boat show in January 2025 and generated a lot of interest.

INDUSTRY

- In Industrial Spraying, business is expected to remain healthy in 2025, particularly in North America. Over the remainder of the fiscal year, the Group will continue to develop and modernize its plants, particularly at Stains (France).

- In Technical Hoses, the Group is pursuing the development of its product ranges and continues to focus on innovation and sustainability, by increasing the proportion of recycled PVC in its hoses.

Daniel Tragus, Chief Executive Officer of the EXEL Industries Group

“EXEL Industries had a mixed first quarter on the back of two years with a very high basis of comparison, but which nevertheless reflected the solidity of its business model. In the agricultural sector, despite the anticipated decline in volumes, the business climate presents more favorable prospects for the coming months. Pre-season Garden sales are encouraging, while Industry sales have held up well. The Group closely monitors the evolution of its activities and adapts its cost structure for the rest of the fiscal year. As a reminder, the first quarter is not very representative due to the seasonality of our activities.”

Upcoming events

- February 4, 2025: Annual General Meeting

- April 29, 2025, before market opening: Q2 2024-2025 revenue

- May 23, 2025, before market opening: H1 2024-2025 results and investor presentation