Growth across all business lines, bolstered by buoyant sales in agricultural equipment

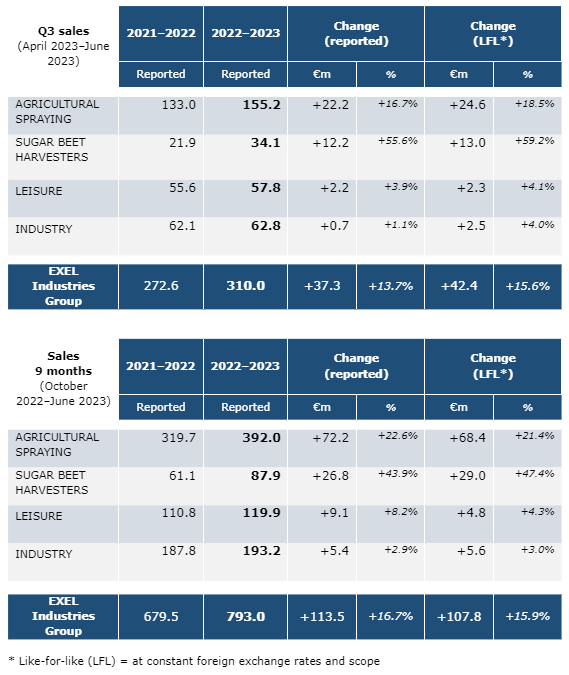

Sales per activity Third quarter 2022-2023

EXEL Industries posted revenue of €310.0 million for the third quarter of fiscal 2022-2023, up 13.7%. Growth at constant consolidation scope and foreign exchange rates was 15.6%, the difference being due to an adverse currency effect and a limited scope effect arising from the consolidation of the Devaux group: the early June 2023 acquisition of Devaux led to the consolidation of a €0.6 million contribution to third quarter revenue.

The Group’s growth continued to be driven by the price increases passed since last year, coupled with sustained volumes in the agricultural equipment and industry businesses, and a favorable basis of comparison.

- AGRICULTURAL SPRAYING UP 16.7%

Revenue increased across all Group regions, particularly France and North America, which recorded brisk sales volumes during the quarter without being as impacted by the shortages as they were the previous fiscal year. - SUGAR BEET HARVESTERS UP 55.6%

Sugar prices stabilized at record high levels. Sales of sugar beet harvesters were bolstered by strong demand in Eastern Europe. - LEISURE UP 3.9%

In a challenging market following extreme adverse weather conditions in May, billings in the garden business held up in terms of volume. The process of integrating Devaux has only just begun. Boat deliveries were lagging behind during this quarter compared to 2022. - INDUSTRY UP 1.1%

Industrial spraying sales were driven by automotive project billings. Sales in Asia and the USA remained stable compared to the previous quarters. In technical hoses, the sluggish economic environment persisted.

Outlook

- AGRICULTURAL SPRAYING

Order books remain well-stocked despite the relative decline in agricultural product prices over the last few weeks. However, the withdrawal from the Ukrainian grain deal will likely impact the grain market over the short term. - SUGAR BEET HARVESTERS

Fourth quarter sales of new machines are expected to be in line with 2021–2022 levels, driven by ongoing increases in sugar and beet prices.

- LEISURE

Since the beginning of January, the watering market has declined slightly in France but remains stable in the United Kingdom. The trend is not expected to change in the fourth quarter.

The process of integrating Devaux has started. As the season was already well underway, Devaux is expected to make only a limited contribution to Group full-year results.

- INDUSTRY

Regional trends are expected to remain the same across the three main markets, marked by stabilization in Europe and ongoing sustained growth in Asia and North America.

- October 26, 2023, before market opening: Q4 2022-2023 revenue

- December 21, 2023, before market opening: 2022-2023 full-year results & SFAF presentation.