Acceleration in growth

Sales per activity Second quarter 2022-2023

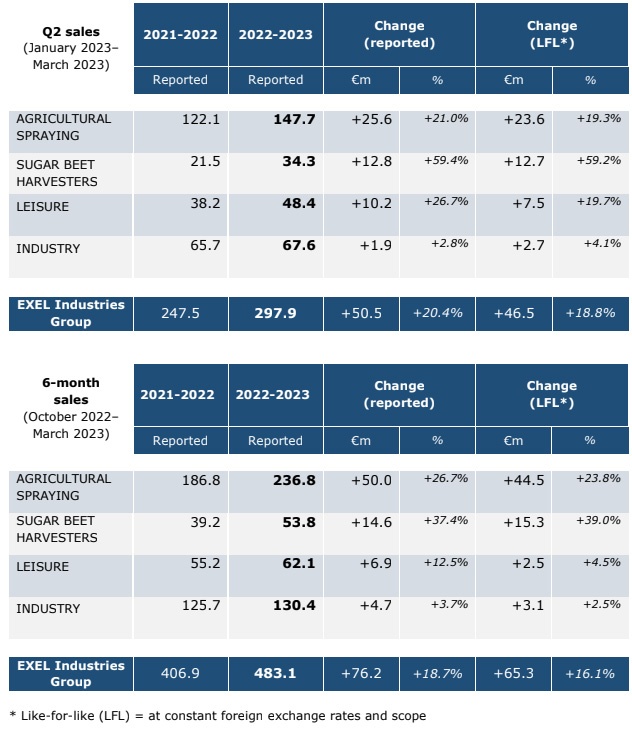

EXEL Industries posted sales of €297.9 million for the second quarter of fiscal 2022-2023, up 20.4%. Growth at constant consolidation scope and foreign exchange rates was 18.8%. Sustained demand in our various end-markets has generally enabled the Group to drive up prices in order to make up for inflation in direct costs.

Given that the Italian company G.F. was acquired on February 15, 2022, the second quarter scope effect was limited to €3.8 million.

- AGRICULTURAL SPRAYING UP 21.0%

After peaking in spring 2022, accentuated by the conflict in Ukraine, the prices of some agricultural commodities including wheat and rapeseed fell slightly but stayed well above pre-COVID levels. As a result, demand remained strong in all regions, enabling the Group to maintain a well-stocked order book.

In addition, sales volumes in the second quarter of the previous fiscal year were particularly affected by major supply chain disruptions. Disruptions continue to curb sales volumes for some brands, albeit to a lesser extent than in 2022. On the other hand, the price increases applied in response to strong inflation also drove sales growth during the quarter.

- SUGAR BEET HARVESTERS UP 59.4%

Sugar prices are experiencing an exceptional but recent surge. Nevertheless, sales improved driven by the market launch of the new Terra Dos 5 sugar beet harvester and strong demand in Eastern Europe.

- LEISURE UP 26.7%

The Garden business posted strong growth in the Group’s three main operating regions (United Kingdom, France and Italy) fueled by favorable comparison with Q2 2022, a particularly challenging period impacted by IT migration and a sluggish market. Volumes are reverting to pre-COVID levels.

- INDUSTRY UP 2.8%

In the Industrial Spraying business, billings continued to grow at the same pace as in the previous quarter, driven by strong momentum in the Asian market. Technical hoses continue to suffer from a decline in volumes observed since the fourth quarter of 2022 which was however offset by higher prices.

Outlook

AGRICULTURAL SPRAYING

- Order books remain well-stocked despite the relative decline in agricultural product prices.

- The Group continues to adjust its selling prices in response to rising purchase costs.

- Sales of the TRAXX autonomous high-clearance tractor and 3S Spot Spray Sensor® high-precision field spraying solution will be spread over the coming trimesters. These two major innovations are the result of work started three years ago by EXXACT Robotics, our pooled research center dedicated to agricultural equipment.

- Business continues to grow in compliance with international regulations in Russia, with strict control of customer receipts.

SUGAR BEET HARVESTERS

- The continued rise in sugar and beet prices is expected to drive sales of new machines in 2022-2023, provided that the shrinkage in surface area is halted.

LEISURE

- Order intake during the second quarter augurs well for the rest of the year. Provided weather conditions remain favorable, business is expected to return to volumes comparable to the pre-COVID period.

INDUSTRY

- Regional trends are expected to remain the same in the three main markets marked by stabilization in Europe and sustained growth in Asia and North America.

Yves Belegaud, Chief Executive Officer of the EXEL Industries Group, said:

“The Group confirmed the excellent first quarter start to the year driven by the agricultural equipment core business and strict discipline in adjusting selling prices. However, inflation and macro-economic uncertainty prompt us to remain vigilant in controlling our costs and working capital requirements. EXEL Industries is pursuing the policy of strong and sustainable innovation that is so highly valued by our demanding users.”

Upcoming events

- May 26, 2023, before market opening: H1 2022-2023 results.

- May 30, 2023: SFAF presentation of H1 2022-2023 results.

- July 25, 2023, before market opening: Q3 2022-2023 sales.